US Export Controls on China Chips Hit 3-Year Mark, Are They Working?

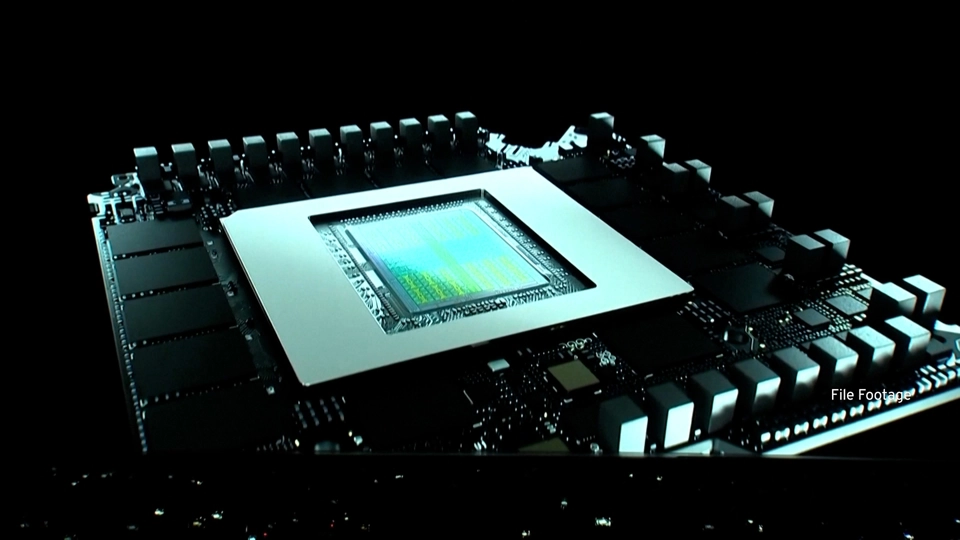

On October 7, 2022, the US imposed sweeping export controls aimed at cutting China off from advanced chips and the tools to make them, including a Foreign Direct Product Rule that extended restrictions to products made with US technology. Three years on, the rules forced redesigns of chips and supply chains, prompted China to retaliate with bans on some US suppliers and reshaped global AI competition, say policy experts and industry figures. With presidents Donald Trump and Xi Jinping set to meet at the upcoming APEC summit, some analysts say a negotiated deal could alter the balance but deep structural rivalry remains. TaiwanPlus takes a look back at the US export controls in this special report.

US-China Export Controls: Three Years On

CHRIS GORIN (REPORTER): On October 7th, 2022, the US drops a bombshell on the tech world, sweeping new export controls, aiming to cut China off from advanced chips and the tools to make them. Coming just weeks before ChatGPT would set off the AI boom, the decision would strongly shape US-China relations and global tech competition over the next three years.

Jake Sullivan (THEN-US NATIONAL SECURITY ADVISOR):

Last week, we launched significant, carefully tailored restrictions of semiconductor technology exports to the prc.

These technologies are used to develop and field advanced military systems, including weapons of mass destruction, hypersonic missiles, autonomous systems and mass surveillance.

CHRIS GORIN (REPORTER): While previous restrictions had targeted single companies like China’s Huawei in 2019, this was a major escalation, covering the entire chip supply chain.

Paul Triolo (SENIOR VP FOR CHINA AND TECHNOLOGY POLICY LEAD, ALBRIGHT STONEBRIDGE GROUP):

So what happened between 2019 and 2022 was AI, right? I mean, basically, AI came into the picture

And the idea was, wow, AI is getting really capable and at some point you might want to control who has access to it, in particular malicious actors.

Lauryn Williams (DEPUTY DIRECTOR AND SENIOR FELLOW, STRATEGIC TECHNOLOGIES PROGRAM, CSIS):

there are different perspectives. And I served in the Biden administration around this time. And so I know that the federal government

was very focused on targeting, kind of the whole supply chain, essentially of semiconductor, um, and an underlying AI technologies.

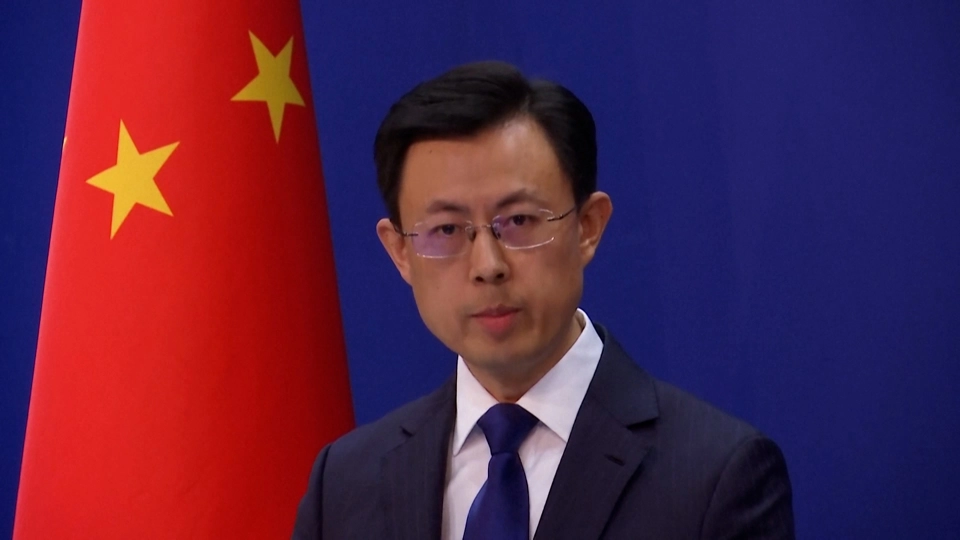

CHRIS GORIN (REPORTER): Beijing strongly objected from the start, calling it an attempt to contain China.

Mao Ning (CHINESE FOREIGN MINISTRY SPOKESPERSON):

The United States politicizes and weaponizes technology and economic and trade issues which cannot block China's development. It will only isolate and harm itself

Xiaomeng Lu (DIRECTOR, GEO-TECHNOLOGY, EURASIA GROUP):

Beijing feels like this is, um, a clear signal of containment of China. Um, I they didn't see that coming exactly,

and they they were shocked at the scope of this, these type of controls.

CHRIS GORIN (REPORTER): A key enforcement tool, known as the Foreign Direct Product Rule, extended the ban not just to US-made products, but to any product made with US technology, anywhere in the world. That had a huge impact even on companies in Taiwan, like chip giant TSMC.

Paul Triolo (SENIOR VP FOR CHINA AND TECHNOLOGY POLICY LEAD, ALBRIGHT STONEBRIDGE GROUP):

even in 2020, uh, TSMC had had to stop collaboration with Huawei. And at that time, Huawei was something like 15% of TSMC's revenue,

the China market. Um, if you look at TSMC, um, and where it was poised to go before the controls, um, was certainly impacted.

CHRIS GORIN (REPORTER): The rules applied not only to chips, but also chipmaking tools like lithography systems. That required buy-in from the governments and companies in countries like Japan and the Netherlands, where these key tools are produced.

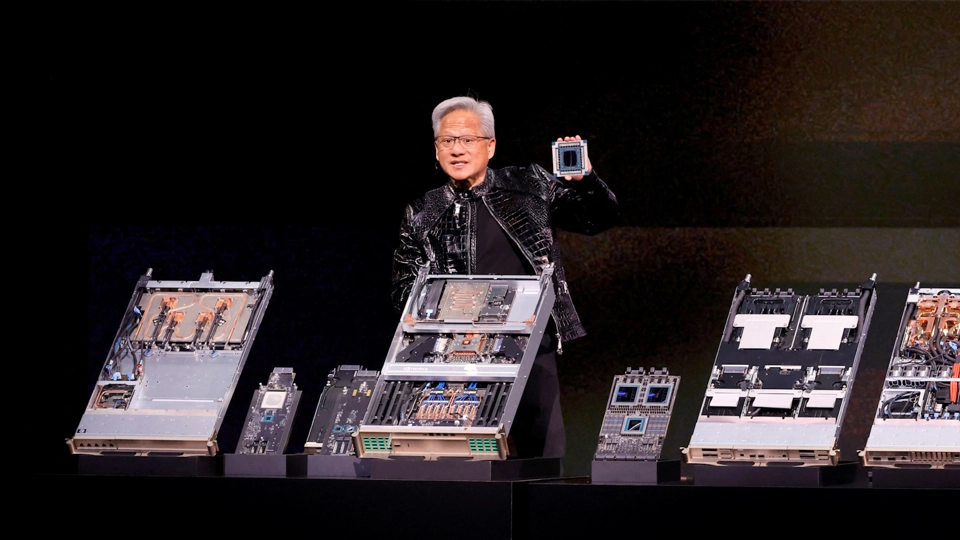

To comply with the rules, some chip designers, like US-based Nvidia, began making new, slower chips specifically for the China market. But in 2023, China began to hit back, banning products from US memory maker Micron in computers deemed sensitive, citing “serious network security risks,” which the US says were false.

Karine Jean-Pierre (THEN-WHITE HOUSE PRESS SECRETARY):

the recent announcement by the PRC regarding Micron, we believe, are not based not based in fact. And so the Department of Commerce is engaged directly with the PRC to detail our views on this.

CHRIS GORIN (REPORTER): In October 2023, almost exactly one year after the controls began, the US expanded restrictions to cover new China-only models from Nvidia and other loopholes, while China banned exports to the US of critical minerals used in military and 5G devices.

In April, President Trump, back in the White House, announced his “liberation day” tariffs on every foreign country. China was hit hardest of all, with tariffs exceeding 100%. China retaliated by issuing its toughest restrictions yet, cutting off multiple rare earth minerals to US companies.

Paul Triolo (SENIOR VP FOR CHINA AND TECHNOLOGY POLICY LEAD, ALBRIGHT STONEBRIDGE GROUP):

I want to just stress how important that is. The world is very different because China...if China now has the ability very quickly to cut off, you know, and damage US companies very quickly, that gives them - you know, they don't want to use overuse that - but it gives them a significant leverage.

Xiaomeng Lu (DIRECTOR, GEO-TECHNOLOGY, EURASIA GROUP):

That's a moment where rubber meets the road and the US decision makers realize, oh, they have a bargaining chip too, and it's equally powerful as ours.

CHRIS GORIN (REPORTER): Just as the tech war seemed to reach a boiling point, both sides pulled back. By June, tariffs were lowered and rare earth bans were lifted. But the friction continues.

Nvidia's attempt to sell its China-only H20 chip saw White House intervention, with Trump demanding a 15% cut of its sales.

The US recently extended export controls to the subsidiaries of sanctioned Chinese firms.

After three years of export controls, have they worked as their creators intended?

Paul Triolo (SENIOR VP FOR CHINA AND TECHNOLOGY POLICY LEAD, ALBRIGHT STONEBRIDGE GROUP):

At one level, yes, there is. You could argue there has been success in slowing down, uh, the ability of Chinese companies to train advanced AI models.

However, um, at the same time, Chinese AI models are very capable and um, Chinese companies now dominate the leaderboard for virtually all open source, open weight models.

Xiaomeng Lu (DIRECTOR, GEO-TECHNOLOGY, EURASIA GROUP):

I think the near term effect is very clear. They want to delay China's technology progress for a few generations and they're there. They definitely achieve that.

I think like 8 or 10 years from now, whether Chinese can can create their own substitute for EUV and and find a way to manufacture in a way that's comparable to TSMC, I think that's the bigger question.

CHRIS GORIN (REPORTER): Now, all eyes are on the upcoming APEC summit in South Korea, where the two presidents are scheduled to meet, and negotiate a potential deal.

Paul Triolo (SENIOR VP FOR CHINA AND TECHNOLOGY POLICY LEAD, ALBRIGHT STONEBRIDGE GROUP):

we could wake up in March of 2026 with a significantly different world where there has been a deal, uh, over sort of trading rare earth access for export controls. This is one potential scenario.

Xiaomeng Lu (DIRECTOR, GEO-TECHNOLOGY, EURASIA GROUP):

when are they going to close the TikTok deal? Uh, whether China will purchase those soybeans and airplanes and whether US government will take half step back on their their Taiwan position? I think those are things that need that take a lot of time to negotiate those details.

CHRIS GORIN (REPORTER): Regardless of any deal, the underlying competition may be here to stay.

Lauryn Williams (DEPUTY DIRECTOR AND SENIOR FELLOW, STRATEGIC TECHNOLOGIES PROGRAM, CSIS):

there aren't all all that many areas of of overlap in our, you know, last two US administrations’ thinking and approaches, but on export controls and on US-China technology competition, especially in these, um, really important technology areas, there has been continuity.

CHRIS GORIN (REPORTER): Three years later. After three years, AI is more critical to our lives and the global economy than ever. And control over that technology remains the key to growth, diplomacy, and power.